Operations includes frequent travel or frequent transportation then managing fuel expenses are an important part of running a small business. Fuel costs can quickly accumulate, making it crucial for business owners to find effective ways to manage and reduce these expenses. Fuel credit cards are one of the most significant tools for managing and reducing transportation expenses.

These cards play an important part in your daily life transportation expenses.These cards offer rewards, discounts, and various perks tailored to the needs of businesses. In this article guide, we’ll go deep into the best fuel credit cards for small businesses, including options that do not require a credit check, to help you make the right decision.

Why Small Businesses Should Consider Fuel Credit Cards

Fuel credit cards are designed to give many other benefits to different kinds of businesses with regular fuel expenses. Here are some reasons listed below why small businesses should consider them. Let’s have a look into them.

1. Cost Savings

Fuel credit cards often give you discounts or cash back on fuel purchases, helping to minimize the overall cost of running your business vehicles.

2. Expense Tracking

Detailed information in the form of statements provided by these cards makes it easier to track fuel expenses, categorize spending, and manage budgets efficiently.

3. Convenience

Accepted at various fuel stations, these cards simplify the refueling process for business owners and employees, ensuring seamless operations.

4. Employee Management

Many fuel credit cards allow business owners to issue cards to employees, set spending limits, and monitor usage, making it easier to manage fuel-related expenses across the company.

5. Improved Cash Flow

With features like flexible billing cycles and delayed payments, fuel credit cards can help improve cash flow management for small businesses.

6. No Credit Check Options

For businesses with limited or no credit history, some cards offer approval without a credit check, making them more accessible.

7. Additional Perks

Beyond fuel discounts, many of these cards provide additional benefits such as rewards on other business expenses, travel perks, and fraud protection.

Top Fuel Credit Cards for Small Business

Let’s explore some of the best fuel credit cards available for small businesses, highlighting their unique benefits and features.

The Shell Small Business Card is a great choice for businesses that frequently refuel at Shell stations. It offers various benefits that can significantly reduce fuel costs.

- Rebates: Earn rebates on fuel purchases at Shell stations, which can add up to significant savings over time.

- No Annual Fee: Enjoy the perks without the burden of an annual fee.

- Detailed Reporting: Track fuel expenses with comprehensive reports, making it easier to manage your budget.

- Customization: Set spending limits for each employee card, ensuring that you maintain control over fuel expenses.

Why It’s Great: This card is perfect for businesses that have a consistent refueling routine at Shell stations. The rebates and reporting tools make it easier to manage and control fuel expenses.

BP’s Business Solutions Fuel Card is another excellent option for small businesses, offering significant savings and flexibility.

- Fuel Discounts: Receive discounts on fuel purchases at BP and Amoco stations.

- Flexible Payment Options: Choose from various billing cycles that align with your business’s cash flow needs.

- Online Account Management: Easily manage your account and track transactions through an online portal.

- Security Features: Protect against unauthorized purchases with PIN security and transaction controls.

Why It’s Great: The BP Business Solutions Fuel Card is ideal for businesses looking for flexibility and substantial savings on fuel expenses. The online management tools also make it easy to keep track of spending.

The WEX Fleet Card is known for its wide acceptance and robust reporting features, making it a popular choice among small business owners.

- Universal Acceptance: Accepted at over 95% of U.S. fuel stations, providing flexibility and convenience.

- Comprehensive Reporting: Access detailed reports to analyze fuel spending patterns and identify areas for savings.

- No Setup Fees: Get started without any initial costs, making it an affordable option for small businesses.

- Rewards: Earn rebates on fuel purchases, which vary based on your monthly volume.

Why It’s Great: This card’s wide acceptance and detailed reporting make it suitable for businesses with diverse travel routes. It helps ensure that you can refuel at almost any station while keeping track of your expenses.

For businesses that frequently use Exxon and Mobil stations, the ExxonMobil BusinessPro Card offers excellent savings and control features

- Fuel Rebates: Get rebates on fuel purchases, which can help reduce your overall fuel expenses.

- Customizable Reporting: Tailor reports to fit your business’s needs, making it easier to manage and analyze expenses.

- Employee Controls: Set spending limits and monitor employee usage to prevent unauthorized transactions.

- 24/7 Customer Service: Access support anytime, ensuring that help is available when you need it.

Why It’s Great: This card is ideal for businesses that want strong oversight of their fuel expenses while enjoying rebates at Exxon and Mobil stations.

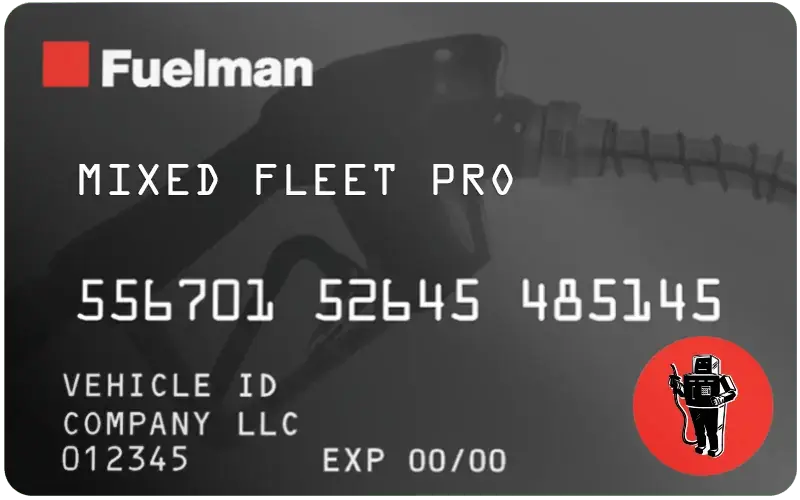

Fuelman Fuel Cards offer a large network of stations and robust management features, making them a solid choice for businesses with substantial fuel needs.

- Wide Network: Accepted at over 50,000 stations nationwide, providing flexibility in where you can refuel.

- Real-Time Alerts: Receive notifications for any unusual fuel card activity, helping to prevent fraud.

- Detailed Reporting: Access comprehensive data to track fuel expenses and monitor spending patterns.

- Savings: Earn rebates based on your monthly fuel purchases, with no cap on the amount you can save.

Why It’s Great: Fuelman Fuel Cards are excellent for businesses that require flexibility and detailed expense tracking. The real-time alerts add an extra layer of security to prevent unauthorized usage.

While not a traditional fuel card, the U.S. Bank Business Leverage Visa Signature Card offers great cash back rewards on fuel and other business expenses

- Cash Back: Earn 2% cash back on fuel purchases and other business-related spending.

- Flexible Rewards: Redeem rewards in various ways, including statement credits, travel, or merchandise.

- Introductory Offer: Take advantage of an initial bonus offer by meeting the spending requirements.

- No Annual Fee for the First Year: Reduce initial costs with a waived annual fee for the first year, making it an attractive option for small businesses.

Why It’s Great: This card offers versatility, providing rewards not just on fuel but on a range of business expenses. It’s a good option for businesses looking for a more comprehensive rewards program.

The Arco Business Solutions Fuel Card is designed to be accessible to businesses without a credit check, offering essential benefits to manage fuel costs.

- No Credit Check: Approval is easier for businesses with limited credit history.

- Fuel Discounts: Save on fuel purchases at participating Arco stations, helping to reduce overall costs.

- Expense Management: Track spending with detailed reports, making it easier to monitor and control fuel expenses.

- Security Features: Protect against unauthorized use with features like transaction limits and alerts.

Why It’s Great: This card is perfect for businesses that need a fuel card without the hassle of a credit check. The fuel discounts and management tools are ideal for keeping fuel expenses in check.

The Fuel Express Card offers universal acceptance and doesn’t require a credit check, making it an excellent option for businesses with limited credit history.

Key Benefits:

- No Credit Check: Get approved without needing a credit history, making it accessible for new businesses.

- Universal Acceptance: Accepted at virtually all gas stations nationwide, providing unparalleled flexibility.

- Expense Tracking: Access detailed transaction records to monitor fuel costs and spending patterns.

- Fleet Management Tools: Manage employee cards and monitor fuel usage efficiently through fleet management tools.

Why It’s Great: Fuel Express Card offers flexibility and robust fuel management features without the need for a credit check, making it a top choice for small businesses seeking convenience and control.

Tips for Choosing the Best Fuel Credit Card for Your Small Business

Selecting the right fuel credit card can make a significant difference in managing your business expenses. Here are some tips to help you choose the best option:

1. Assess Your Fuel Needs

Consider the amount of fuel your business consumes and the stations you frequently visit. Choose a card that offers the best rebates or discounts for your typical usage.

2. Look for Additional Perks

Beyond fuel savings, consider cards that offer rewards on other business expenses, such as travel, dining, or office supplies. Additional perks can enhance the overall value of the card.

3. Consider Credit Requirements

If your business has a strong credit history, you have a wider range of options. However, if you’re a new business or have limited credit, focus on cards that offer approval without a credit check.

4. Compare Fees and Interest Rates

Review the annual fees, setup fees, and interest rates associated with each card. Some cards offer introductory APRs, which can help manage cash flow, especially in the early stages of your business.

5. Read the Terms and Conditions

Understand the terms, including rebate caps, fuel station restrictions, and billing cycles, to ensure you can maximize the benefits without surprises.

6. Seek User Reviews

Research user reviews and ratings to gain insights into the card’s performance, customer service, and overall satisfaction. This can help you make a more informed decision.

7. Evaluate Fleet Management Tools

For businesses with multiple vehicles, consider cards that offer robust fleet management tools. These features can help you monitor fuel usage, set spending limits, and prevent unauthorized transactions.

Conclusion

Fuel credit cards offer an effective way for small businesses to manage and reduce fuel expenses while enjoying additional perks such as rewards, discounts, and expense management tools. Whether you’re looking for cards with no credit check or ones that provide extensive rewards, there’s a wide range of options available to suit your business needs. By carefully evaluating your fuel consumption, credit history, and the additional benefits each card offers, you can select the best fuel credit card for your small business, helping you maximize savings and streamline operations.