Travel can be a regular part of working for new and old business owners and business executives. As you have to travel for different purposes related to your business and to grow your business locally as well as on an international level. For many other purposes, like having meetings with clients, attending different industry events, and availing of new and best opportunities, the associated costs can accumulate quickly.

Your right choice of choosing the right and best business credit card can lighten your traveling expenses by giving you rewards, benefits, and many other perks specifically designed for travelers who travel often for their needs. In this article, we will explore the best business credit card for travel, which will help you to make an informed and right decision adjusted to your business requirements.

Why Opt for a Business Travel Credit Card?

The cards which are used as business travel credit cards offer a variety of advantages to its uses. It is a fact that it separates your personal finances from business expenses.Beyond the basic convenience of separating personal and business expenses,these credit cards offer you travel specific rewards and many other travel benefits that can lead you to immense savings. Here are some points described to understand that why you should consider a best travel business credit card:

- Enhanced Rewards: You can earn points or miles on every travel-related purchase. Miles can be redeemed to use for your travel expenses in future.

- Exclusive Perks: Enjoy benefits such as complimentary lounge access, priority boarding, and travel insurance.

- Expense Management: Simplify accounting with detailed spending reports and the ability to issue cards to employees.

Higher Limits: Business cards typically offer higher credit limits than personal cards, accommodating larger business expenses. Credit limit is also an important factor when you are considering the right choice of picking up the right card.

Top Business Credit Cards for Travel

Let’s explore different top picks that you should consider while selecting your right choice of business travel credit card. Here are some points that are highlighting the features, benefits of a travel credit card. Let’s see how they can serve you different types of business needs.

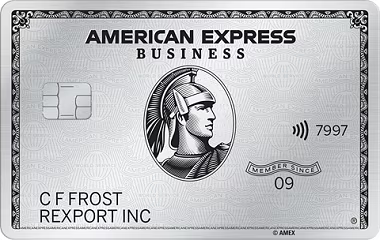

Why It Stands Out: Known as one of the best luxury travel credit cards, this card is a top choice for those seeking premium travel benefits. Here are some points that will show you how and why it stands out.

- Rewards: Earn 5X Membership Rewards® points on flights and prepaid hotels booked through Amex Travel.

- Lounge Access: Get access to the exclusive Global Lounge Collection, including Centurion Lounges and Priority Pass Select.

- Annual Airline Credit: Receive up to $200 in statement credits annually for incidental airline fees.

- Hotel Benefits: Enjoy perks at over 1,000 Fine Hotels & Resorts properties worldwide, such as room upgrades and late checkout.

- Travel Insurance: Comprehensive coverage including trip delay and baggage insurance.

- Concierge Service: Access to 24/7 concierge service for reservations and special requests.

Ideal For: Business travelers who prioritize luxury and comfort, and those who frequently book through Amex Travel.

Rewards Program: A versatile card known for its generous point-earning potential, especially in categories relevant to businesses. You can earn rewards in the form of points or cash back and also as miles. And then you can use redemption options to redeem your rewards in various forms.

- Points Earnings: Earn 3X points on the first $150,000 spent on travel and select business categories each account anniversary year.

- Sign-Up Bonus: A significant sign-up bonus of up to 100,000 points after meeting the initial spending requirement.

- Travel Protection: Includes trip cancellation/interruption insurance and cell phone protection.

- No Foreign Transaction Fees: Save on international purchases.

- Flexible Redemption: Points can be redeemed for travel through Chase Ultimate Rewards or transferred to partner loyalty programs.

Ideal For: Businesses looking for the best travel credit card for business with broad earning categories and flexible redemption options.

Simplicity and Value: This card offers a straightforward rewards system with no complicated categories to track. It becomes easier when you have not any complicated ways to earn more points in the form of rewards.

- Rewards: Earn unlimited 2X miles on every purchase, with no caps or restrictions.

- Travel Perks: Get reimbursed for Global Entry or TSA PreCheck application fees.

- No Foreign Transaction Fees: An excellent choice for businesses with international dealings.

- Miles Transfer: Transfer miles to over 15 leading travel loyalty programs. Miles can be redeemed and can be used for your next travel expense. Earning more miles will lead you to saving your traveling expenses.

- Lounge Access: Access to Capital One lounges and complimentary Priority Pass membership.

Ideal For: Entrepreneurs who prefer simplicity in earning and redeeming rewards without compromising on travel benefits.

Tailored for American Airlines Flyers: This card is ideal for businesses that frequently book flights with American Airlines. Choose your required card according to your habits and needs.

- Miles Earnings: Earn 2X AAdvantage® miles on eligible American Airlines purchases and 1X on other purchases.

- Companion Certificate: Earn a companion certificate each year after meeting the spending threshold.

- Travel Perks: Enjoy preferred boarding and your first checked bag free on domestic American Airlines itineraries.

- No Foreign Transaction Fees: Travel abroad without incurring additional charges.

Ideal For: Small business owners who frequently fly with American Airlines and want to maximize their travel rewards.

Delta SkyMiles® Platinum Business American Express Card

Delta Loyalists: A must-have for businesses that rely on Delta Airlines for their travel needs.

- Miles Earnings: Earn 3X miles on Delta purchases and 1.5X miles on eligible purchases after reaching a monthly spending threshold.

- Medallion Qualification Boost: Accelerate your path to Delta Medallion Status with additional Medallion Qualification Miles (MQMs).

- Companion Certificate: Receive a companion certificate for domestic travel each year upon renewal.

- Priority Boarding and Checked Bag: Enjoy priority boarding and your first checked bag free on Delta flights.

Key Considerations When Choosing a Travel Business Credit Card

When selecting the best business credit card for travel rewards, consider the following factors to ensure it aligns with your business objectives:

- Spending Patterns: Analyze your business’s spending habits. Choose a card that offers the highest rewards in your most frequent spending categories, such as travel, dining, or office supplies.

- Travel Frequency: If you or your employees travel frequently, prioritize cards with travel-related perks like lounge access, free checked bags, or travel credits.

- Employee Card Benefits: Look for cards that offer free employee cards and the ability to set individual spending limits. Because limits set according to the card is also important.

- Redemption Flexibility: Some cards offer more versatile points or miles redemption options, allowing you to maximize the value of your rewards.

- Sign-Up Bonuses: Consider the value of the sign-up bonus and whether the spending requirement is achievable based on your business’s usual expenses.

- Annual Fees: Evaluate the cost of the card’s annual fee against the benefits and rewards offered. A higher fee may be worth it for the right perks and rewards. It will help you to gain more and more rewards.

How to Maximize Your Business Travel Credit Card Benefits

Having the best credit card for business travelers is only beneficial if you use it wisely. And for using it wisely it will have to be according to your habits and needs. Then you will be able to use it wisely, monitoring your habits and needs. Here are some tips to get the most out of your card:

- Use for Business Travel: Ensure all travel-related expenses are charged to your business travel card to earn maximum rewards. When doing this you earn miles on using your credit card for your travel expenses. And later on you can redeem your miles to use for your travel expenses.

- Leverage Lounge Access: Take advantage of complimentary lounge access to make business travel more comfortable.

- Book Through the Card’s Portal: Some cards offer higher rewards rates or discounts when booking travel through their dedicated portal.

- Monitor Expenses: Use the card’s expense tracking tools to monitor and manage business spending effectively. You can easily track your business spending and can manage it more effectively.

- Redeem Rewards Strategically: Plan your reward redemptions to coincide with business travel needs for maximum savings. Right choice often leads you to immense savings.

In Short

Choosing the best business credit card for travel can remarkably play a role in the enhancement of your business travel experience. Your right selection can offer you valuable rewards and many convenient perks.Whether you organize luxury, rewards on everyday expenses, or flexibility to redeem your rewards, there’s a card that matches your business’s unique needs. By keeping your travel habits in your mind and also business goals, you can pick a card that helps you save money, enjoy better travel experiences, and manage expenses more efficiently.